Principal Financial Group Dividend History: A 2025 Perspective

Principal Financial Group (PFG) currently offers a dividend yield of approximately 3.43% (as of February 12, 2025) 1, a figure that often attracts investor interest. However, a comprehensive analysis requires a deeper dive into PFG's dividend history, current performance, and future prospects. This involves understanding the factors driving past payouts and assessing the inherent risks associated with future dividend payments.

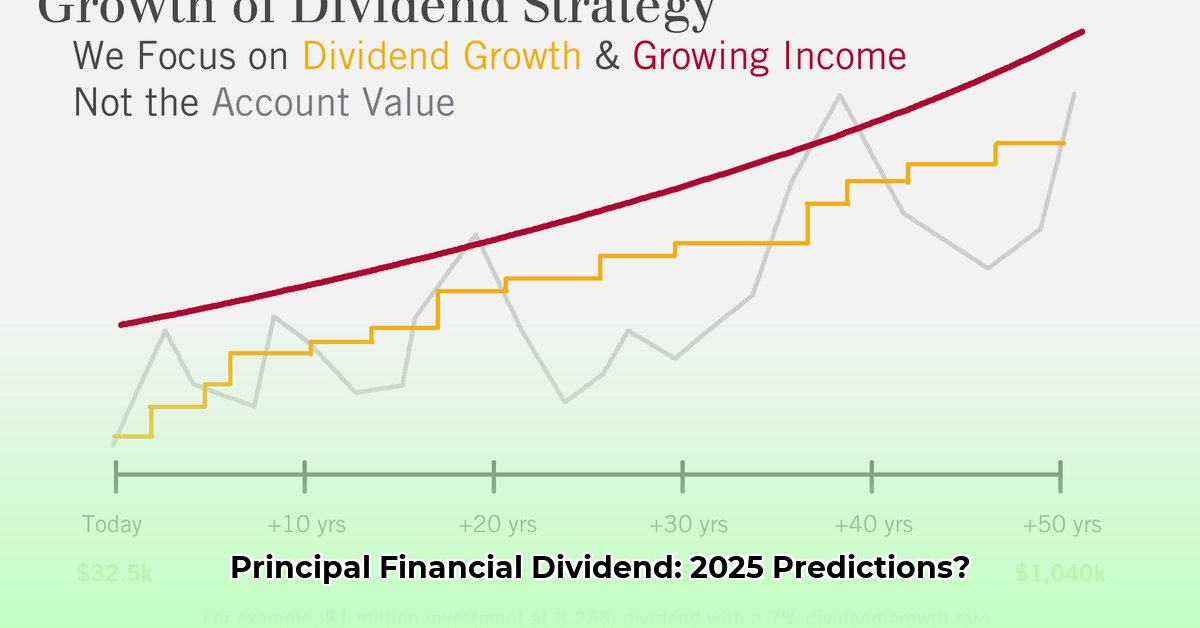

Understanding the PFG Dividend Story

PFG's recent annual dividend payout of roughly $2.91 per share, distributed quarterly, suggests a commitment to shareholder returns. This consistent pattern is encouraging, but a complete picture requires more than just examining current yields. Past performance, while informative, does not guarantee future results. Accurately forecasting future dividends necessitates analyzing the payout ratio (percentage of earnings paid out as dividends) and projecting future earnings—a complex undertaking with inherent uncertainties. This complexity underscores the challenges in providing a definitive outlook. Isn't it crucial to understand these nuances before making investment decisions?

Navigating the Risks of PFG Investment

Investing in PFG, like any investment, carries inherent risks. Potential challenges include:

- Economic Slowdowns: Recessions can negatively impact PFG's profitability, potentially affecting dividend payments. The importance of diversification cannot be overstated.

- Intense Competition: The financial services industry is fiercely competitive. PFG's ability to maintain market share and profitability directly influences its dividend capacity.

- Regulatory Changes: Evolving government regulations in the financial sector can significantly impact operational strategies and, consequently, dividend payouts.

- Unforeseen Events: While less predictable, unexpected expenses or strategic shifts could theoretically affect short-term dividend payments.

A Strategic Approach to PFG Investing

Despite these risks, PFG's consistent dividend payments remain attractive, especially for income-oriented investors. However, a prudent approach is crucial.

Steps for Informed Investment:

- Monitor Quarterly Earnings: Regularly review PFG's quarterly earnings reports for insights into the company's financial performance. This proactive monitoring enables more informed investment decisions.

- Comparative Analysis: Compare PFG's dividend yield against similar investments to gauge its relative attractiveness. A comparative analysis helps determine whether PFG presents a compelling investment opportunity.

- Diversify Your Portfolio: Distribute your investments across various asset classes to mitigate overall risk. Diversification is a cornerstone of effective risk management.

- Long-Term Perspective: Consider the long-term implications of PFG's potential dividend increases or decreases, factoring in its performance and macroeconomic conditions. A long-term perspective is vital for sound investment strategy.

PFG Dividend History: A Deeper Dive

To fully grasp PFG's dividend history, the broader economic context must be considered. The interplay between PFG's performance, market conditions, and overall economic trends shapes its dividend policy. A long-term perspective that accounts for these interconnected factors is essential for a comprehensive understanding. It is worth noting, as a quantifiable fact, that PFG's dividend growth rate over the past 10 years has been 9.40%. This historical trend, however, provides only a snapshot and does not preclude future adjustments.

How to Assess Principal Financial Group (PFG) Dividend Sustainability

Key Takeaways:

- PFG's dividend history displays growth, but sustainability requires careful evaluation.

- Moderate payout ratios suggest fiscal prudence but limit the potential for extremely rapid dividend growth.

- Macroeconomic factors significantly influence PFG's dividend-paying capacity.

- A balanced approach, incorporating a long-term view, considering both short-term yield and long-term growth prospects, is vital for investors.

Analyzing PFG's Dividend Health: Key Metrics

Evaluating PFG's dividend sustainability demands a multifaceted approach. Key metrics include:

- Dividend Growth Rate: While PFG's 10-year growth rate of 9.40% is noteworthy, past performance is not indicative of future results.

- Payout Ratio: A moderate payout ratio suggests fiscal responsibility but may limit aggressive dividend increases.

- Financial Health: Revenue growth, earnings per share (EPS), and return on equity (ROE) are crucial indicators of financial strength. PFG’s relative performance compared to its competitors deserves attention.

- External Factors: Interest rate fluctuations, economic cycles, and regulatory changes impact the financial services sector and must be considered.

Risk Assessment: A Cautious Approach

Investing in PFG involves understanding and accounting for several risks. Economic downturns can reduce profitability and dividend payments. Intense competition within the financial services industry requires the company to remain competitive. Regulatory changes add another layer of uncertainty. A diversified investment strategy is a prudent approach.

Actionable Insights for Investors

For current shareholders: Continuously monitor earnings reports and analyze dividend growth trends. For potential investors: Conduct a thorough comparative analysis of PFG against competitors, and carefully assess yield and long-term growth potential. Understanding management's long-term strategy is vital.

| Stakeholder | Short-Term Focus | Long-Term Focus |

|---|---|---|

| Current Shareholders | Monitor earnings, assess dividend growth prospects | Diversify holdings & consider alternative income streams |

| Potential Investors | Evaluate PFG against competitors; analyze yield | Assess long-term growth plans and strategic initiatives |

| Management | Maintain fiscal discipline, strategic reinvestment | Drive revenue growth, enhance profitability, manage risks |

Conclusion: A Balanced Perspective on PFG Dividends

PFG's dividend history provides a compelling case study in evaluating dividend sustainability. While the company demonstrates a commitment to shareholder returns, a balanced assessment involves considering its financial health, market dynamics, and inherent risks. Thorough due diligence remains crucial for informed investment decisions.